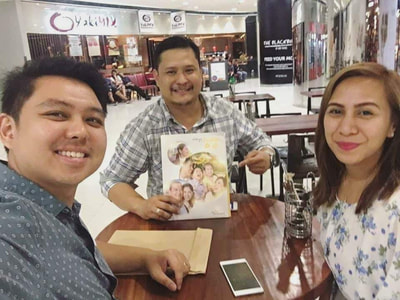

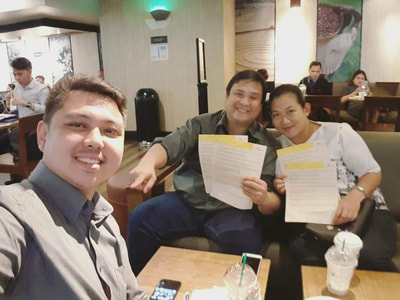

L-R: Aunt, Mom, GrandMa L-R: Aunt, Mom, GrandMa I grew up in a household of an entrepreneur mom and an OFW dad which led me to ponder on how my life will be in the future. My parents work hard during their younger days and this equates to providing a comfortable life for the family. That kind of providence allowed me to spend summer vacations with my Grandma in GuaGua, Pampanga. The joyful memories of the untainted scent of rice field in the morning, swimming in the water reservoir, regular ride on carabao cart had me well-adjusted with the rural life and hillbilly friends whom I was able to learn the dialect. My vacations usually coincides with the time of the year where my Grandma stays there for the yearly harvest on the Family’s Rice field. For decades, she is the sole provider of her family. Grandma, given her predicament puts her family first. My mom’s fortunate siblings get a piece of the pie every year and her good heart extends to me as she buys me stuffs. With whatever is left, she budgets her monthly spending until the next harvest. In the competitive world of advertising you often must have fresh ideas. I have been in the industry for more than a decade. I have maintained ties with my former colleagues some of whom have either transferred to another department or a competing media outfit. One of them, an advertising agent and a friend had to go through a paradigm shift and shared with me his new found advocacy - Financial Literacy. I told him that he’s in luck for I know the importance of saving a portion of my income every payday and it’s on top of my list. I immediately requested from CJ Blanco, an isurance overage proposal for me and my significant half with an allocation around five thousand monthly for each of us. To date, we’ve been SunLife policy holders for more than a year and continuously inquires from our FA about additional investment offerings from Sun Life to check if it can still fit our budget for investment. I'm happy to share also in this blog that four of our children are now SunLife Planholders. Teaching them to save at an early age is also helping them acquire not only money that can help them build a brighter future but also the attitude of saving and preparing for their uncertain horizon.

In retrospect, living a comfortable life today does not promise the same luxury in the future. It is all about how one manages his or her finances at present and prepare for a favorable future. Live Brighter!

0 Comments

Leave a Reply. |

Archives

December 2021

Categories

All

|

RSS Feed

RSS Feed