|

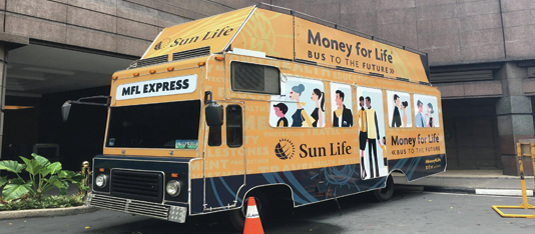

Security is a word that most of us cling to. Imagine your "today" unprotected from what a complicated world has to offer. A prudent man would in any way keep his head above the tides until he goes to safety(his ideal future). On the other hand, a rash person would poorly deal with his present that mostly sums up to an atrocious future. Sun Life of Canada (Philippines), Inc., the top-ranked and the longest-standing life insurance company in the Philippines, aims to serve five million clients by 2020 under its new five-year growth plan that is dubbed as “Rise PH” “Rise PH” champion’s financial inclusion in the Philippines, where only a small percentage of the whole population utilizes financial products such as insurance and investments. “Despite the bright prospects that the country’s economy has, prosperity still hasn’t trickled down to the more disadvantaged sectors of society. We have to address this”, Sun Life President and CEO Riza Mantaring said. “Sun Life would like to see more Filipinos looking forward to a brighter future and the whole country rising to greater heights. We would like to start by targeting five million clients in five years. While it may seem like an ambitious goal, Mantaring believes that it’s best to set the targets high. “At Sun Life, we always dare to dream big – more so if the stakes are high. This is the country’s future we’re talking about, after all”, she explained. “Setting high targets will push us to do more, and will allow us to make a greater contribution to our country’s future.” In order to reach the company’s goals, several initiatives will be launched under “Rise PH”. These initiatives will have Sun Life reaching out a broader market, further boosting its financial literacy advocacy, and expanding its reach nationwide. Financial Independent Month The initial set of initiatives will be launched this June, which Sun Life has declared as Financial Independence Month. This includes the cooperation with 8990 Holdings Inc., one of the top mass housing developers in the country, for efforts to promote finacial literacy. Another initiative is Money for Life, a comprehensive customizable financial planning program that will ensure a client to have sufficient funds in every stages of his life. To help insure the public to create their own Money for Life plan with financial adisor, Sun Life created a 360-degree visual reality (VR) video, transporting them to different scenario based on their chosen life stage. This will enable the viewer to live the dream for a minute and be encourgaed to start planning for their future through Money for Life and Sun Life’s life insurance and investment products. Viewable with a VR headset, the video can be experienced in a customizable bus “Bus to the Future” which will be making its way to different malls and school campuses nationwide from June 11 to July 2.

Meanwhile, those who will not be able to visit the “Bus to the Future” stops will still get a boost in their financial journey with the Money for Life e-planner. They simply have to go to at moneyforlife.com.ph and they can start their financial planning, get product recommnedations, and even buy mutual funds froim Sun Life Asset management Co., Inc. Financial Independence Month is now on its third year highlighting the national importance of financial preparedness among Filipinos. “This June marks a new beginning as Sun Life embraces its goal of serving five million clients in five years,” Mantaring said. “We are very much excited about the possibilities, and we look forward to helping our country rise to reach its potential.”

0 Comments

Leave a Reply. |

Archives

December 2021

Categories

All

|

RSS Feed

RSS Feed